OH MY GOD! Why Did My Tax Assessment Go Up

Your property taxes will only go up if your rate or assessment amount increases and refinancing your home including the appraisal does not impact either of these numbers. The timing of an assessment after a decision is entered depends on whether an appeal is filed.

Property Tax Assessment What It Is And What It Means Credible

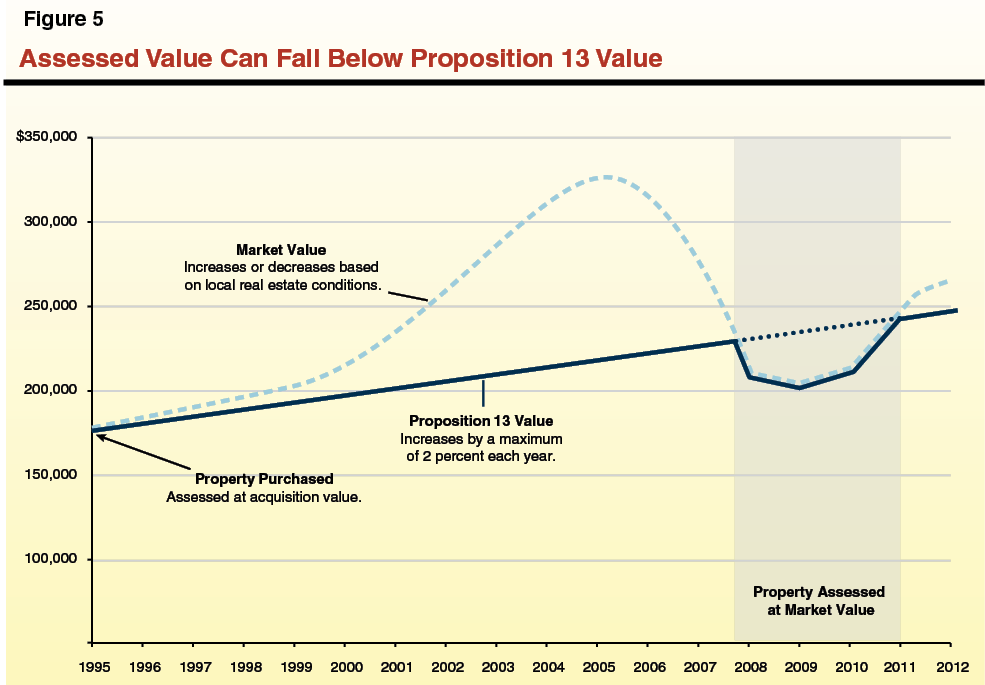

Proposition 13 allows for an increase of up to 2 of property value.

Why did my tax assessment go up. If its assessed value grows because of home improvements your tax bill will grow even if the tax rate stays the same says Martin Marshall county administrator in Lenawee County Michigan. In non-TEFRA cases the taxpayer is mailed a notification that a tax plus interest and additions and penalties if any is due and a demand for payment. The main reason that taxes rose in 2020 and are likely to rise again in 2021 is the soaring housing market.

For TEFRA cases see CCDM 359352. Are property taxes going up in 2021. Special Assessments can also cause an increase or decrease from year to year.

For a detailed discussion of appeals see CCDM Part 36. Because the current year tax bill is calculated based on the prior year tax bill changes in assessed value do not have as much impact on a tax bill up or down as they did prior to the law change. If the local property tax agency has lowered the assessment on your house that might eventually translate into a lower monthly.

Property tax bills can increase for a variety of reasons. If assessments increase tax rates should go down proportionally. The only way that you can connect the refinance process to.

Your mortgage company may use the assessment data in order to estimate your. My property tax bills are about 4500. If tax rates go up or stay the same it simply means that.

Why did my tax bill increase when my assessed value decreased or did not change. More then half of that is to the school taxes. I bought my house a few years ago in eastern pa.

This is because the tax levy is now being distributed over a broader tax base. No wonder why the house prices in my neighborhood are so low- if they go up the taxes will be over the roof. If tax rates go up or stay the same it simply means that the municipality or school district is collecting more in taxes.

Also the tax rate in your area can increase as new voter approved bonds are added or decrease as existing bonds are paid off. Property taxes are usually calculated as a percentage of a homes taxable value. Proration and Adjustment of Tax Data at an Escrow Closing.

If your home is assessed at 300000 and your tax rate is 3 percent youll pay 9000 a year in property tax. This is because the tax levy is now being distributed over a broader tax base. My houses assessed value is 44200.

The tax assessed value is only used to determine property taxes. When home prices go up local government has a larger tax base leading to higher bills for homeowners. Your local state or federal government laws may change causing property taxes to spike.

When a reassessment results in increased assessments due to rising property values tax rates should go down proportionally.

Property Tax Assessment And What It Means Quicken Loans

Understanding California S Property Taxes

Deducting Property Taxes H R Block

Property Tax Assessment Appeal Letter How To Write Examples

Understanding California S Property Taxes

Property Tax Assessments And How They Re Calculated Rocket Mortgage

Property Tax Assessment What It Is And What It Means Credible

Publication 908 02 2021 Bankruptcy Tax Guide Internal Revenue Service

Types Of Taxes Income Property Goods Services Federal State

Property Tax Assessment Appeal Letter How To Write Examples

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Honolulu Property Tax Fiscal 2021 2022

The Top Seven Questions About Irs Tax Transcripts H R Block

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Assessment Appeal Letter How To Write Examples

Your Tax Assessment Vs Property Tax What S The Difference

Property Tax Assessment Appeal Letter How To Write Examples